Jamaica’s strong post-COVID-19 economic resurgence continued with significant out-turns:

• 4.2 per cent growth bet-ween January and March and 2.3 per cent for April to June.

• Estimated 2.9 per cent growth between January and June.

• 4.5 per cent record low unemployment rate.

• Decrease in the number of unemployed persons by 27,500 or 30.7 percentage points to 62,200 in July.

• Reduction in youth (14-24) unemployment by 9,000, or 26 per cent, to 25,600.

• Increase in the number of employed persons by 47,000 to 1,315,100.

• Increase in the labour force complement by 19,600 or 1.4 per cent to 1,377,300.

• 30.6 per cent increase in export earnings between January and July, totalling just over US$1.22 billion.

• Decline in inflation for October to 5.1 per cent, which placed the rate within the Bank of Jamaica (BOJ) 4-6 per cent target range.

• Net International Reserves (NIR) totalling approximately US$4.61 billion.

Global Credit Rating

• Moody’s Investor Service revised its economic outlook for Jamaica from ‘Stable’ to ‘Positive’, while Standard and Poor’s Global Ratings and Fitch Ratings maintained a ‘Stable’ rating.

Bilateral/Multilateral Funding Support

• Approximately US$1.7 billion approved for Jamaica under the International Monetary Fund (IMF) Precautionary and Liquidity Line (PLL) and Resilience and Sustainability Facility (RSF).

Local Funding Support

• The Development Bank of Jamaica (DBJ) allocated $100 million for first-year implementation of the Growth and Expansion of MSMEs through Innovation and Capacity-building Grant Pilot Programme.

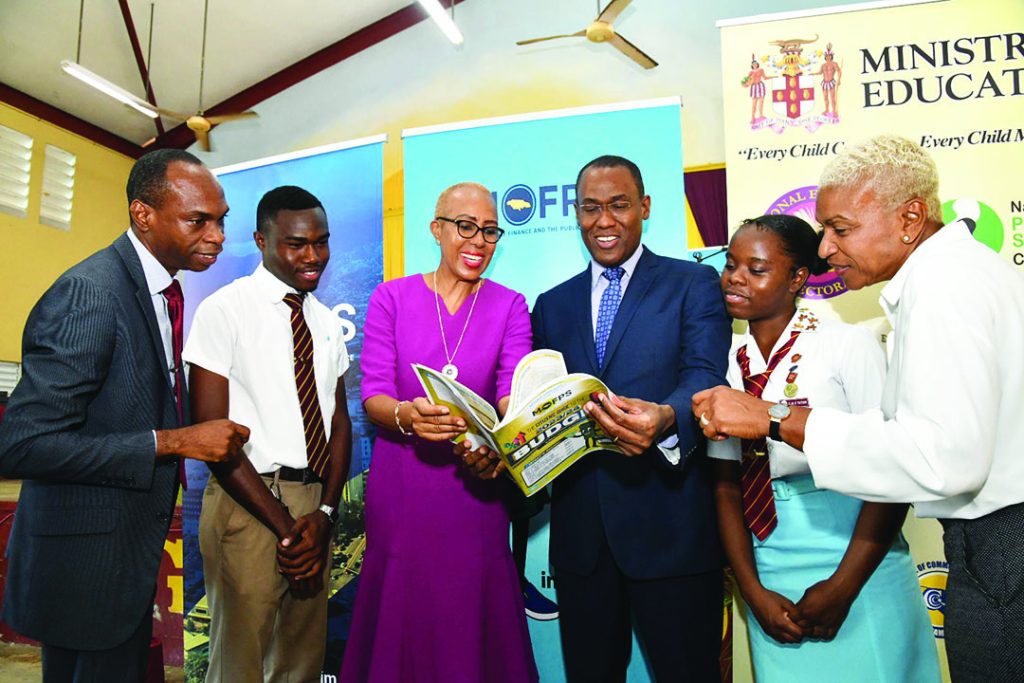

Budget

• Jamaica’s first trillion-dollar Budget was tabled in February.